News and Reflections

How the focus on year end destroys value

Deloitte recently released their latest paper on red tape focused on companies' own rules entitled "Get out of your own way" and I'd certainly include the budgeting and financial reporting that businesses do as part of this.

Do you have a lighthouse for your organisation?

There is a middle way between having a rigid multi-year plan and an ad hoc strategy decision making process. Its by identifying the Lighthouse.

Superhero or Servant Leader - You Choose!

Our problem lies in the fact that our culture has fallen in love with the idea of the celebrity CEO and this has shifted the priorities of CEOs away from fundamental leadership. Here’s some food for thought…

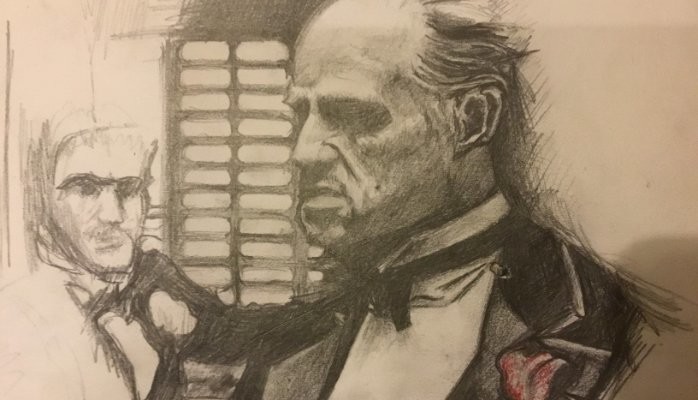

It's Not Personal - It's Just (Family) Business

At some point a second generation leader has to step forward and implement the transition as a professional CEO. Here’s how to make it happen and ensure a sustainable, successful family business.

A Joined Up Journey to Business Excellence

When senior executives and business leaders are trying to get their minds around how to raise the bar in business performance where do they look? The trouble is the focus is more usually on the achievement and less about the journey itself. Here is how to shift from surviving to thriving…